Click to Discover the Top 10 Mexican Cities for Quality of Life in 2024: Key Insights for Manufacturing Expansion

Reshoring Trend Continues: U.S. Manufacturing Companies Leaving China

- Hits: 1264

In our previous article from September 2019 the U.S. and China were fully entangled in a trade war with an ever-increasing list of Chinese imports subject to new U.S. tariffs.

Now a year later, the trade war continues to impact manufacturers’ resilience, productivity, and profits.

Whether or not the U.S. and China are able to normalize their trade relationship one thing has become clear: unpredictability is not cost effective.

This article is a follow up to our original article: A Long Time Coming: Accelerated Exodus of Companies Leaving China for Mexico Due to Prolonged Trade War and Tariffs.

In April 2020, 64% of companies across the manufacturing and industrial sector, “are likely to bring manufacturing production and sourcing back to North America,” according to a Thomas survey of 878 North American manufacturing and industrial sector professionals. The Thomas survey showed manufacturers experienced production hold ups and shortages when their factories were shut down during the outbreak of COVID-19. The pandemic coupled with ongoing tariffs on imports from China has made single source operations out of China untenable. It is time to rethink their entire supply chains.

Manufacturers are beginning to pull out of China and are reshoring production closer to home. For some this means exploring the U.S., for other manufacturers this means looking to the low-cost country (LCC), Mexico. Mexico manufacturing fulfills the need for low-cost, highly skilled labor while offering the advantages that come with the proximity to your final market and the deeply embedded and friendly trade relationship we have with our southern neighbor.

Major Factors Contributing to Reshoring Production

- Unpredictable and continuing trade war, U.S. tariffs on Chinese imports

- COVID-19 pandemic

- Supply chain disruptions and transportation delays/costs

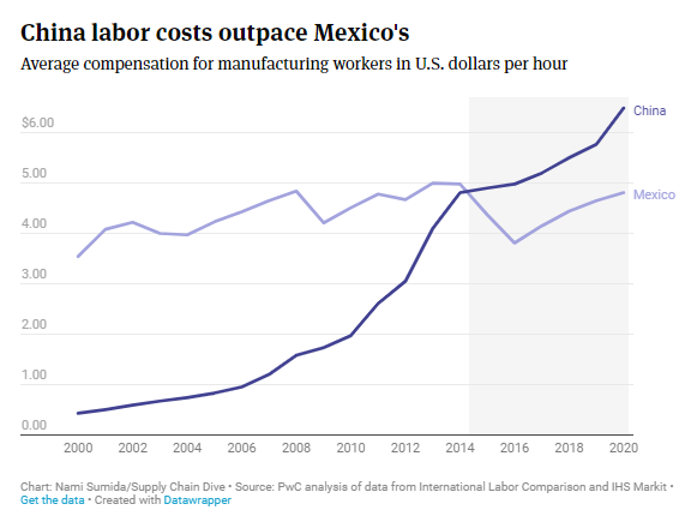

- Manufacturing labor rates in China continue to be higher than in Mexico ($4.12/hour in China versus $3.50/hour in Mexico)

"Three decades ago, U.S. producers began manufacturing and sourcing in China for one reason: costs. The trade war brought a second dimension more fully into the equation―risk―as tariffs and the threat of disrupted China imports prompted companies to weigh surety of supply more fully alongside costs. COVID-19 brings a third dimension more fully into the mix, and arguably to the fore: resilience―the ability to foresee and adapt to unforeseen systemic shocks," says Patrick Van den Bossche, Kearney partner and co-author of the 19-page report 2019 Kearney US Reshoring Index.

Read: What is reshoring in manufacturing?

How Mexico Addresses Costs, Risk, and Resilience in the Manufacturing Supply Chain

Manufacturing executives are looking to lower costs, minimize risk, and increase supply chain resilience. With widely felt supply chain disruptions manufacturers are looking to Mexico for business continuity and long-term solutions. Let’s take a look at how Mexico addresses these needs.

- Labor costs are lower in Mexico versus China

Labor costs in China surpassed Mexico’s labor costs approximately five years ago. One added advantage of Mexico is its familial and cultural ties with the United States. You don’t find that in China. Much of Mexico’s workforce is bilingual and culturally aligned with the U.S.

-

Supply chain resilience and favorable trade relationships

The United States, Mexico and Canada have all ratified the new NAFTA called the USMCA, continuing the nearly 26-year-old success story of tariff-free trade across North America. Mexico also has 14 free trade agreements (FTAs) with over 50 countries, giving manufacturers in Mexico access to over 60% of the world’s gross domestic product (GDP). The new CPTPP gives manufacturers and suppliers in Mexico tariff-free access to 11 countries throughout the Asia-Pacific (Canada, Australia, Brunei, Chile, Japan, Malaysia, Mexico, New Zealand, Peru, Singapore and Vietnam). Free trade and friendly trade relationships make manufacturers less prone to supply chain disruptions.

Further reading: USMCA Goes into Effect: What are the Major Changes?

-

Lower transportation costs to U.S. markets, eliminate container shipping

Mexico dedicated commercial border crossings along the U.S.-Mexico border and deep-water ports connected to the world. The total time and cost it takes for container ships to reach the U.S. from overseas significantly impacts your speed to market. - Mexico is regionally strategic and provides ideal proximity to your customers and markets

Every expert agrees, the way to mitigate risks and increase just-in-time delivery is to get to as close to your market as possible. When it comes to U.S. manufacturers and the U.S. market, you can’t get closer than Mexico. -

Mexico’s established and robust manufacturing industries

Further reading: Manufacturing Industry in Mexico: Key Sectors

Mexico has an over 50-year history supporting global manufacturing powerhouses and small to medium sized manufacturers looking for increased margins and proximity to their customers. Decades of foreign direct investment (FDI) and governmental investment in the billions of dollars for modern facilities, infrastructure, import/export efficiency, roads, electricity, and water.

Soft Landing in Mexico with a Shelter Company: How to Get Up and Running with Minimal Risk & Costs

Because of the acceleration of tariff announcements and changes, companies are looking towards shelter services providers with relocation services when looking to nearshore production to Mexico from their overseas locations.

Shelter companies in Mexico allow manufacturers to operate under their existing corporate entity, utilize existing permits, and reduce ramp up times to just a few months. They also provide site selection services, administrative support, HR, recruitment, and in effect handle every aspect outside of the actual manufacturing. Shelter companies can even assist with knowledge transfer and immigration of some overseas workers to reduce training needs. This is the speed and cost savings needed for smoother transitions during these unpredictable times in international trade and manufacturing.

Sources:

- Supply Chain Drive: 64% of manufacturers say reshoring is likely following pandemic: survey (May 2020)

- Supply Chain Drive: 6 charts show global trade and supply chain nearshoring trends (June 2020)

- Kearney 2019 Reshoring Index