Click to Discover the Top 10 Mexican Cities for Quality of Life in 2024: Key Insights for Manufacturing Expansion

Trump Is Ready To Renegotiate NAFTA. Here’s What That Might Look Like.

- Hits: 363

Donald Trump campaigned for the presidency by deriding NAFTA, the free trade pact between the US, Canada, and Mexico, as a job killer and “the worst trade deal maybe ever signed anywhere, but certainly ever signed in this country." Just a few weeks into office, he’s getting ready to renegotiate it.

During a meeting with congressional leaders at the White House last week, Trump slammed NAFTA as a ”catastrophe for our workers and our jobs and our companies," and declared his intention to “kick-start” negotiations with the US’s partners as quickly as possible. That was the day after the Mexican government announced that it had begun a 90-day period of consulting with its business sector in preparation for NAFTA talks. Canada hasn’t made indications about a timeline yet, but said it’s open to renegotiation as well.

Foreign leaders take Trump seriously when he talks about transforming trade relations. He used his first full working day in office to pull out of what would’ve been the biggest free trade accord in history, the Trans-Pacific Partnership (TPP). On NAFTA, he plans, at a minimum, to try to renegotiate its terms. During his Senate confirmation hearing in January, commerce secretary nominee Wilbur Ross declared that “all aspects of NAFTA will be put on the table” during a future negotiation process.

Trump has made it clear that if he doesn’t get what he wants, he may withdraw altogether, a move that could cause enormous economic harm to the US, Mexico, and Canada, which have tightly intertwined economies and together form one of the biggest free trade zones in the world through NAFTA.

Remarkably, one of the aspects of NAFTA renegotiation could involve a discussion of moving away from the norm of zero trade barriers. That was implied by White House press secretary Sean Spicer when he made some ambiguous and contradictory comments recently about taxing Mexican imports, either in the form of an obscure reform to the tax code or through tariffs. They were framed as a way to force Mexico to fund a wall along the US-Mexico border, not a proposal for how to change NAFTA, but analysts say they could provide a glimpse into the shape of future NAFTA negotiations all the same.

A radical change to tariff policy under NAFTA or outright withdrawal could jolt the US economy because it could disrupt cross-border supply chains and transform import and export patterns. And it wouldn’t necessarily boost the heartland manufacturing jobs that Trump has promised his voters he would revive. In fact, the US and Mexico have such tightly interconnected economies that putting up trade barriers today could end up causing more job losses than were caused by NAFTA in the first place.

Why NAFTA matters so much

The framework for NAFTA was drafted by Ronald Reagan, negotiated by George H.W. Bush, and finally signed into law by Bill Clinton in 1993. Clinton made some tweaks to it with side agreements on labor and environmental rules to secure support from some Democrats in Congress, but overall the free trade agreement commanded thoroughly bipartisan support as it became law. NAFTA passed the House of Representatives 234-200, with 132 Republicans and 102 Democrats voting in favor of it, and the Senate 61-38, supported by 34 Republicans and 27 Democrats.

NAFTA eliminated virtually all barriers to trade and investment between the US, Canada, and Mexico. The removal of trade barriers like tariffs — border taxes that make foreign imports more expensive — created a massive free trade zone that gave businesses in each country a much bigger set of options for where to make their goods, as well as a much bigger market for selling them.

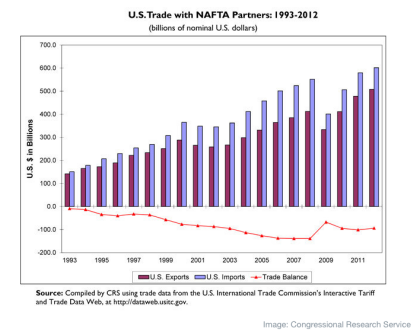

The main reason Trump has been criticizing NAFTA is because the US has a trade deficit with its NAFTA partners, meaning that the US imports more from Canada and Mexico than Mexico and Canada import from the US.

The US-Canadian goods trade deficit was only about $15 billion in 2015, but the one between the US and Mexico was a much bigger $50 billion that same year. The main dynamic underlying that trade deficit that Trump is concerned with — and the one that helped him seize the White House — is the migration of US manufacturing jobs to Mexico. The Economic Policy Institute, a left-leaning think tank in Washington, estimates that the US has lost some 700,000 jobs to Mexico in the two-plus decades since NAFTA went into effect.

But at this point, the US’s enhanced exports to Mexico and the cheap goods it receives from there as a result of NAFTA also support many US jobs. Demand for US goods in Mexico is a domestic job creator, and when American consumers can spend less on something because it comes cheaper from across the border, they have more money to spend on other goods and services in the US — which boosts the economy and creates jobs. All told, US trade with Mexico supports nearly 5 million jobs in the US, according to a 2016 study by the Wilson Center, a nonpartisan think tank.

Does Trump actually have the authority to change NAFTA?

Trump appears to be gearing up to begin negotiations with Mexico and Canada — a process that would take months or possibly even years to see if they can all agree to new terms.

If Trump simply wishes to negotiate tariffs on specific goods, that’s something he can do without Congress. But if he wants to change NAFTA substantively on issues like labor regulations, then the legislative branch will most likely have to be involved.

“If a newly renegotiated NAFTA meant that the US was taking on more obligation, that we had to change our laws and regulations to be in conformity with it, then Congress would have to pass that,” said Chad Bown, a senior fellow at the Peterson Institute for International Economics, a Washington-based think tank that is generally pro–free trade.

The working assumption among trade analysts is that Trump has some latitude to renegotiate NAFTA using his existing trade promotion authority — a policy that lets the White House negotiate trade agreements and submit them to Congress for a simple up-or-down vote — granted to the president by Congress under the Obama administration. That power lasts until 2018, and can be extended by Congress until 2021.

If that analysis is correct, Trump could submit a renegotiated NAFTA to Congress, which would then vote either yes or no on it — without the ability to offer any changes to the deal at all.

It’s immensely difficult to predict the prospects of a renegotiated NAFTA in Congress, not only because it depends on what specific changes were being added to it but also because the free trade consensus in Washington has dissipated rapidly in just the past few years. Establishment Republican lawmakers are still fond of the free trade status quo, but the rise of Trump on the right and Sen. Bernie Sanders on the left has helped popularize skepticism of multilateral free trade deals.

Right now, though, the bigger issue is that nobody knows how Trump actually wants to change free trade in North America.

What would actually be negotiated over?

Trade experts are entirely unclear on what course of action Trump is actually likely to pursue at the negotiating table. And lack of clarity regarding his goals is compounded by the fact that two out of three of his major trade picks for his administration don’t have experience forging trade agreements.

Ross, the commerce secretary nominee, and Peter Navarro, Trump’s pick for the newly created National Trade and Industrial Council, have stances on trade policy but have no experience negotiating trade policy. (Robert Lighthizer, Trump’s pick for US trade representative, does have experience doing so a long time ago, under Reagan.) It’s safe to assume that many of Trump’s top people on trade are not up to date with the way trade talks have been operating as of late.

That said, there are a few key areas that could be up for discussion:

Tariffs: Trump may try to create exceptions to the NAFTA norm of zero tariffs, according to some trade analysts. He could do something like argue for the countries to be able to use tariffs on certain goods like textiles or automobiles. Trump’s hope would be that the increased cost of them coming across the border would make domestic production of those goods more competitive, and boost domestic production as a result. But Trump will have an extremely difficult time getting Canada or Mexico to agree to raising tariffs.

Rules of origin: Another major point that could be up for negotiation could be the wonkily named “rules of origin,” or the percentage of a finished product that must be made in North America in order to be considered eligible for the NAFTA free trade treatment.

Currently under NAFTA, a car, for example, has to have 62.5 percent of its parts made somewhere in North America in order to not face tariffs while moving across borders. The rest of the product could be made using parts from, say, China. One option on the negotiating table would be to raise that standard to boost domestic manufacturing. If that threshold were raised to 80 percent, say, it would mean that 80 percent of the car’s parts would have to be from North America and a maximum of 20 percent could come from outside the free trade bloc.

“If they raised the regional content standard, it would force producers to have more of the content sourced from within North America — not necessarily from the US — but it would increase the likelihood that it would come from within the US,” Christopher Wilson, deputy director of the Mexico Institute at the Wilson Center, says.

This is a point of negotiation that all three countries could plausibly agree to, because if executed properly, it could boost domestic production in all of them. But the threshold would have to be raised carefully — raising it too high on some products could ultimately cause their manufacturers to leave North America altogether.

Labor and environmental standards: The Trump administration could also discuss raising labor and environmental standards under NAFTA in a bid to make American workers more competitive. By demanding more stringent standards and enforcement of standards regarding issues like minimum wages, union organizing rights, workplace safety, and environmental impact, the cost of doing business in Mexico will go up, and blunt some of the edge that lower-paid Mexican workers have over more expensive US workers.

Would Mexico agree to these regulations that could eat away at the bottom line of its businesses? “It’s really likely they would do it — given that they just agreed to do it on the TPP,” Bown said.

During the TPP negotiations, Mexico was ready to adopt enhanced labor and environmental standards. Steven Mnuchin, Trump’s pick for Treasury secretary, recently indicated that the Trump administration may be ready to pick up on the template that was agreed to during that process. “I would hope that the starting point is the work that you've done,” Mnuchin told one TPP backer during his confirmation hearing, according to the Financial Times.

It remains to be seen how negotiations over the future of NAFTA will play out. But we do know they’ll be high-stakes: Both the US and Mexican governments have threatened to pull out NAFTA if they can’t find common ground during renegotiation — something that either country can do unilaterally under Article 2205 of NAFTA.

Mexico is likely to be scrappy during this fight, and Wilson said it could try to use non-NAFTA issues as bargaining tool, such as the way it has clamped down on Central American immigration flowing toward the US or the way it monitors national security threats that could be headed over the US-Mexico border. “They want the US to know that everything is on the table,” Wilson said.

Source: Vox

By: Zeeshan Aleem