Click to Discover the Top 10 Mexican Cities for Quality of Life in 2024: Key Insights for Manufacturing Expansion

Schnurman: We Need More NAFTA, Not Less

- Hits: 440

When Democrats recently rejected a trade proposal involving Pacific nations, some cited the North American Free Trade Agreement as a turning point for working Americans.

"Since NAFTA, we have hollowed out the middle class," a California congressman said, pointing to a drop in manufacturing jobs and stagnation in wages.

But Texas has been booming since the law passed 21 years ago. The state has added over 4 million jobs, which is more new hires than larger California and twice the growth rate of the nation.

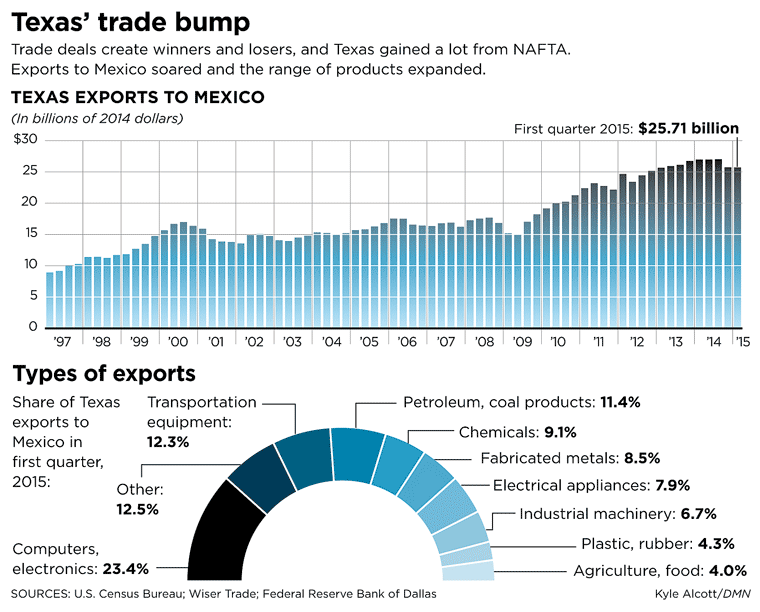

Trade with Mexico and Canada has taken off, and Texas exports to Mexico have nearly tripled. Foreign investment in all three countries has soared. And U.S. trade in private services, a national strength, tripled to $30 billion in Mexico and increased even more in Canada.

In autos, Mexico has become a world-class manufacturer location, which has improved prospects for the entire industry in North America. Consumers have benefited from cheaper, better products; one firm said the cost of basic household goods in Mexico has fallen by half since the trade deal took effect.

There have been disappointments, most notably the failure to close the wage gap for Mexican workers. Wages have grown just 1.2 percent annually since NAFTA, slower than in Brazil, Chile and Peru. But that doesn't negate the upside.

"The problem isn't too much NAFTA," said Pia Orrenius, a senior economist at the Federal Reserve Bank of Dallas. "If anything, we need more."

President Barack Obama, whose Pacific trade plan was initially rebuffed by Democrats, got his fast-track authority through the House last week. But a related bill, an assistance plan for workers displaced by trade, remains unresolved, and that could threaten the whole pact.

The proposed Trans-Pacific Partnership involves about a dozen Pacific Rim countries, and NAFTA has been considered a model. Yet economists and others still disagree about NAFTA's impact, and they often deride the initial promises and fears.

While some talked up the growth potential, others warned of U.S. jobs moving en masse to Mexico — creating what presidential candidate Ross Perot described in 1992 as a "giant sucking sound."

"In reality, NAFTA did not cause the huge job losses feared by the critics or the large economic gains predicted by supporters," said a Congressional Research Service report prepared for Congress in April.

The net effect of NAFTA nationwide has been relatively small, the report said, because total trade with Mexico and Canada accounts for less than 5 percent of gross domestic product. By itself, it's not large enough to move the needle on the giant U.S. economy.

But some numbers are impressive. Annual trade within NAFTA increased from $290 billion to over $1.1 trillion, according to a report by the Council on Foreign Relations. The U.S. trades more goods and services with Mexico and Canada than it does with Japan, South Korea, Brazil, Russia, India and China combined, it said.

As with all trade pacts, there have been winners and losers, both by industry and location. The garment business in El Paso was devastated after NAFTA, Orrenius said. And many factories around the Texas-Mexico border moved farther south.

New opportunities emerged in mexican logistics, transportation, warehousing and high-end services, such as legal and financial. That reallocation of resources was essential to becoming more efficient and competitive, and it eventually strengthened the economy.

"That's the miracle of trade," Orrenius said, pointing to major improvements in Mexican manufacturing, including autos, refrigerators and TVs.

In 2008, Japan still exported twice as many vehicles to the U.S. as Mexico, according to a Wharton School report. Mexico is projected to be the leader this year after all the big global automakers have invested billions in new plants and worker training.

U.S. workers have seen a decline in their share of North American auto jobs while Mexico's share has grown. But with the rise of globalization, isn't it better to have more work for a neighbor?

"If autos weren't made in Mexico, they could've gone to India, Thailand or Romania," said Michael Robinet, managing director of IHS Automotive, a consulting firm.

NAFTA allows the auto industry to integrate parts and suppliers across all three countries. That's resulted in more competitive vehicles for the region and stronger exports beyond North America. Economists also estimate that 40 percent of the content in Mexican imports originated in the U.S. That compares with 4 percent U.S. content in Chinese imports.

At the same time, Texas exports to Mexico have grown more diverse, led by computers, electronics manufacturing and transportation equipment.

"It benefits Texas to be next to a manufacturing powerhouse," Orrenius said.

It's also a reason that fewer Mexicans are migrating here: Their country is doing better.

Source: www.dallasnews.com

By Mitchell Schnurman