For those watching Mexico for its achievements in the economic field, rather than for the problems caused by Insecurity, the country has advanced enormously over the last decade.

Mexico, regarded as one of the emerging economies within the emerging advanced Group (N11) and according to Goldman Sachs' renowned economist Jim O'Neil who coined the term BRIC (Brazil, Russia, India and China), Mexico has the potential to be included in this group comprised by emerging economies representing more than 1% of the global GDP growth.

Foreign direct investment (FDI) is, from my point of view, a very efficient thermometer to measure behavior, trends and degree of global trust in a country's economy. In the case of Mexico, its economic and political stability has been able to offset the negative image of insecurity. According to the January 2011 economic report by the Ministry of the Economy, during 2010, Mexico captured $17.725 billion dollars (bd) of foreign direct investment, amounting to 16.6% higher than the $15.205 bd captured in 2009. However, during the period January-June 2011 the FDI amounted to $10.601 billion dollars, a decrease of 13.4% compared to the same period of 2010, showing a downward trend, according to the National Commission of Foreign Investments (CNIE).

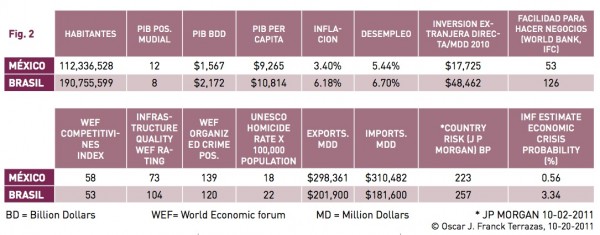

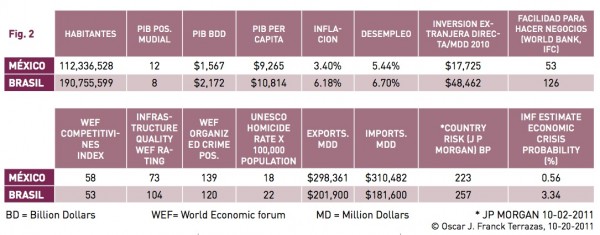

If we compare the $17.725 bdd of FDI received in 2010 with the one captured by Brazil which reached $48.462 bd it is clear that Mexico has a lot to improve in this area. One of the main causes of this substantial difference is the poor handling of Mexico ́s image to the world. Although Brazil ́s homicide rate, according to UNESCO, is significantly higher than that of Mexico, Brazil has a much better public image.

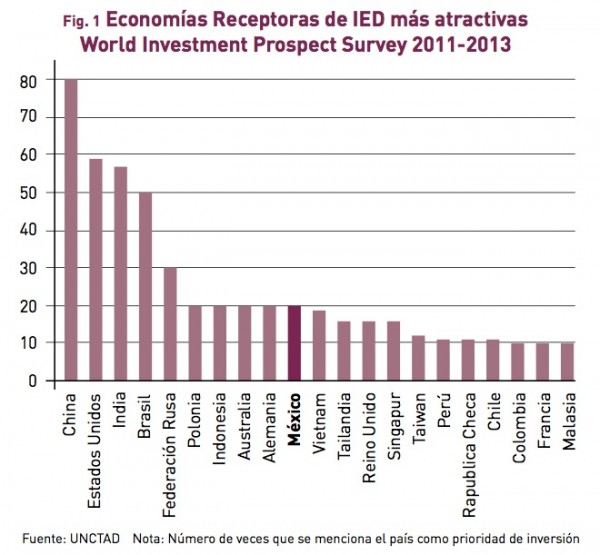

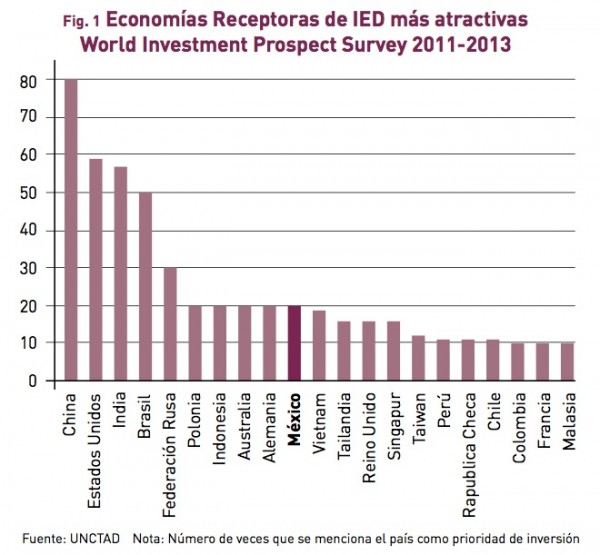

For the investors, the most attractive sectors during 2010 were: manufacturing at 59.7%; commerce at 14.2%, and financial services at 13.8%. In 2011, the most attractive sectors have been: manufacturing at 37.7%; financial services at 21.5%; commerce at 13.8%; massive information media at 10.0% and mining at 5.3%. Also, during the period January June 2011 FDI came mostly from the United States of America (74.1%); Switzerland (11.7%); Spain (8.5%); France (1.4%) and the Virgin Islands and Denmark (1.0% each). In 2010 Mexico ranked No. 19 among the countries recipients of FDI. According to the World Investment Prospect 2011-2013 survey on the most attractive FDI recipient economies, Mexico shares the 6th position, along with Poland, Indonesia, Australia and Germany (Fig. 1).

Among the features that have given Mexico a positive profile as emerging economy, are its population, its export capacity and the growth of its manufacturing industry. However, this has not been reflected in the country's average growth during the last decade, which is lower than that reached by the majority of emerging economies.

Among the features that have given Mexico a positive profile as emerging economy, are its population, its export capacity and the growth of its manufacturing industry. However, this has not been reflected in the country's average growth during the last decade, which is lower than that reached by the majority of emerging economies. Analyzing the income per capita growth in Mexico, we find that its growth has been stunted, especially compared to other countries. In the past 30 years, the average growth of the GDP per person in Mexico has been only 0.67%, contrasting noticeably with what other economies have achieved, such as Chile (4.3%), India (6.1%), China (7.9%) or South Korea (6.6%). According to Banamex estimates, the GDP per capita in Mexico at the end of 2010 was $9,265, while Brazil was $10,814 who, since the economic recession of 2009 displaced Mexico as the country in Latin America with the highest GDP per capita. This is an indication that the domestic market of Mexico is not growing at the same pace as in other emerging economies and, as expressed by International Consultants, S.C., Mexico has lost international competitiveness for its inadequate infrastructure, the low quality of its institutions, backlog in the training of human resources and a shortage of industrial funding, among many others. As a result, Mexico lost 6 places in the 2010 classification of Global Competitiveness of the World Economic Forum but gained 2 positions in 2011 occupying the 58 place among 133 countries, while Brazil advanced to the 53 position.

Although the advances have been many and valuable, it is clear that Mexico needs in a matter of priority, to reposition its level of competitiveness by improving its infrastructure and raising the quality of their institutions, and very importantly, to find appropriate formulas to combat successfully the organized crime; struggle that costs the country between 1 to 3% of GDP (no data on this economic cost is available), as well as the loss of life, tourism and capitals not coming due to fear of insecurity.

While previously Mexico was a country in which its basket contained two enormous eggs called oil and remittances from nationals abroad, and the other few eggs in the basket were much smaller, the manufacturing ind comes "Stagnant", Mexico's exports to the USA will be seriously affected.

The strong growth in the industrial manufacturing sector had triggered an improvement of the industrial real estate. If this growth continues, we can expect an increase in the demand for industrial space; especially in buildings of class A and A +'s latest generation and "built to suit" buildings which are the properties that have a greater demand among international companies. It is important mentioning that in Mexico typical leases of commercial space (industrial, office or retail) are mostly based in US Dollars, being more attractive to investors; while in Brazil lease contracts are in Reais.

At the moment and although there is concern about the significant devaluation of the peso during the month of September and by the strong slowing of the US economy, inflation in Mexico still is under control showing an annual growth of 3.42% for the month of August 2011. International reserves of Mexico have established historical records during the 3Q-2011, reaching $137,038 million dollars. Mexico's country risk in October 2 stood at 236 bp representing an increase of 87 basis points above the level reported at the end of 2010. It must be said that the country risk factor, measured by emerging markets bond index of J.P. Morgan, generally rose, as soon as the degree of qualification of the USA debt was downgraded to AA + in August 2011 by S&P. Comparatively, while Mexico's country risk stood at 236 pb, Argentina's was 984 pb and Brazil was 273 pb.

Although the media in the United States is prompt to blame the European Union as sole responsible for the instability of the global economy, with roots in the crisis of Greece, EC President José Manuel Barroso has strongly indicated that although the European Union has to face the most serious challenges of this generation, the situation is not as drastic as presented by the media; and that (he) has not doubt that the European Union will be more integrated, more united and stronger in the future; that the EU has the capability to solve the problems afflicting it now and that Greece will come ahead implementing the changes recommended by the Commission in its charge.

On the political side, both Mexico and the USA are facing presidential elections in 2012 and, unfortunately, many decisions on economic issues taken now or postponed have a political interest rather than a purely economic view. President Obama introduced a new economic proposal to reduce the deficit by $3 trillion dollars in the next 10 years and another $1.5 trillion by allowing tax cuts created during the Bush era for those earning more than $1 million dollars a year to expire and by limiting tax deductions for those earning more than $250,000. Additionally, President Obama has submitted a new plan to create jobs which has a $447 bd price tag. Many economists estimate that the plan would increase GDP by 1.3% in 2012. If that happens, the unemployment rate could fall to 8.6% by the end of 2012, instead of the 8.9% which now prevails, by means of the creation of 1.9 million jobs, if the plan is approved by Congress. Anyway, given the volatility of the economy in Europe and the United States of America, the IMF reduced its global growth forecast to 4% for 2011 and 2012, and the prognosis of the Mexico ́s GDP growth dropped 0.9 point base moving it from 4.7% to 3.8%.

The IMF warned in its last report (09-212011) "Perspectives for the Global Economy" that the stage pointing to the downside risks, perceives the possibility of a recession in United States and Euro zone, which would imply an economic activity below 3% in 2012 than the one expected on the base scenario, "damaging other economies". Regarding the United States, the IMF points out that the priorities of the United States should include a plan of fiscal consolidation in the medium term and implementing policies to sustain the recovery, including relaxing the labor and housing markets adjustment.

The relevant elements involved in the environment of global economic instability are numerous and many of these are beyond the control of Mexico. Mexico ́s economy remains strongly linked to the performance of the economy of the United States and I believe that the level of dependence will increase in the future as Mexico increases its exports to that country. An example is Mexico ́s automotive industry which has come to resolve the problem of the high costs of production in the USA, as well as in other countries, largely making it possible for a successful return of the automobile market in the USA. In 2009, in the article Mexico in Time of Crisis I pointed out that the automotive industry crisis in the United States would have very positive results for Mexico, and so it happened. Since then, the vast majority of the major automakers worldwide have established manufacturing facilities in Mexico or increased existing ones. Although on a smaller scale, the same is happening in the aerospace industry.

In addition to its proximity to the USA, Mexico offers the ideal formula of a cost competitive, high-quality labor force and top level executives that have an excellent level of education with a majority fluent in English. Nowadays, Mexico is the 12th economy in the world, the second in Latin America and the forecasts for its GDP growth for 2011 (3.8%) and 2012 (3.6%) are the same as Brazil ́s according to the IMF: However Mexico ́s account balance is 1.0% of GDP while Brazil ́s is 2.3%. There are other very interesting comparison points between these two leading economies of Latin America that support the theory that Mexico will be part of the BRIC in the near future (see Fig. 2).

Hoping for the United States to avoid falling into another recession, the future of Mexico should be very encouraging; especially if it improves its infrastructure and reduces the insecurity which would raise the foreign direct investment and its GDP growth. In this scenario, one would expect that the manufacturing sector growth trend will continued rising, pushing the GDP growth above 4%. Mexico has been making a strong presence in the emerging economies scenarios, being the prediction of a number of analysts and economists, with whom I concur, that Mexico has the qualities needed to make his debut on the main stage and it is only a step away from it.

Source: inmobiliare.com

Among the features that have given Mexico a positive profile as emerging economy, are its population, its export capacity and the growth of its manufacturing industry. However, this has not been reflected in the country's average growth during the last decade, which is lower than that reached by the majority of emerging economies. Analyzing the income per capita growth in Mexico, we find that its growth has been stunted, especially compared to other countries. In the past 30 years, the average growth of the GDP per person in Mexico has been only 0.67%, contrasting noticeably with what other economies have achieved, such as Chile (4.3%), India (6.1%), China (7.9%) or South Korea (6.6%). According to Banamex estimates, the GDP per capita in Mexico at the end of 2010 was $9,265, while Brazil was $10,814 who, since the economic recession of 2009 displaced Mexico as the country in Latin America with the highest GDP per capita. This is an indication that the domestic market of Mexico is not growing at the same pace as in other emerging economies and, as expressed by International Consultants, S.C., Mexico has lost international competitiveness for its inadequate infrastructure, the low quality of its institutions, backlog in the training of human resources and a shortage of industrial funding, among many others. As a result, Mexico lost 6 places in the 2010 classification of Global Competitiveness of the World Economic Forum but gained 2 positions in 2011 occupying the 58 place among 133 countries, while Brazil advanced to the 53 position.

Among the features that have given Mexico a positive profile as emerging economy, are its population, its export capacity and the growth of its manufacturing industry. However, this has not been reflected in the country's average growth during the last decade, which is lower than that reached by the majority of emerging economies. Analyzing the income per capita growth in Mexico, we find that its growth has been stunted, especially compared to other countries. In the past 30 years, the average growth of the GDP per person in Mexico has been only 0.67%, contrasting noticeably with what other economies have achieved, such as Chile (4.3%), India (6.1%), China (7.9%) or South Korea (6.6%). According to Banamex estimates, the GDP per capita in Mexico at the end of 2010 was $9,265, while Brazil was $10,814 who, since the economic recession of 2009 displaced Mexico as the country in Latin America with the highest GDP per capita. This is an indication that the domestic market of Mexico is not growing at the same pace as in other emerging economies and, as expressed by International Consultants, S.C., Mexico has lost international competitiveness for its inadequate infrastructure, the low quality of its institutions, backlog in the training of human resources and a shortage of industrial funding, among many others. As a result, Mexico lost 6 places in the 2010 classification of Global Competitiveness of the World Economic Forum but gained 2 positions in 2011 occupying the 58 place among 133 countries, while Brazil advanced to the 53 position. Hoping for the United States to avoid falling into another recession, the future of Mexico should be very encouraging; especially if it improves its infrastructure and reduces the insecurity which would raise the foreign direct investment and its GDP growth. In this scenario, one would expect that the manufacturing sector growth trend will continued rising, pushing the GDP growth above 4%. Mexico has been making a strong presence in the emerging economies scenarios, being the prediction of a number of analysts and economists, with whom I concur, that Mexico has the qualities needed to make his debut on the main stage and it is only a step away from it.

Hoping for the United States to avoid falling into another recession, the future of Mexico should be very encouraging; especially if it improves its infrastructure and reduces the insecurity which would raise the foreign direct investment and its GDP growth. In this scenario, one would expect that the manufacturing sector growth trend will continued rising, pushing the GDP growth above 4%. Mexico has been making a strong presence in the emerging economies scenarios, being the prediction of a number of analysts and economists, with whom I concur, that Mexico has the qualities needed to make his debut on the main stage and it is only a step away from it.